Input Tax Credits under GST. STAFF WELFARE EXPENSES.

Configuring Financials To Bring In Your Own Chart Of Accounts

Employee relations employee morale and employee performance.

. Compensation for injuries at work. 31 March 2008 Any expense which relates to welfare of staff or for banefit of staff including refreshment which could not be shown as any other head like salary should. These days entities started focusing more on well-being of their employees.

20 of the QPE incurred. What are staff welfare expenses. In other words any purchase you make for the purpose of running.

There are so many expenditures which are incurred in respect of the employees of the business firm. In this backdrop the paper writer has examined the eligibility to credit on the employee costs. What all comes under.

Income minus deductible expenses Generally deductible business expenses are those. Company vans and fuel. You need to account for output tax on the goods given to your employees except when.

80000 - 5000 75000. Beneficial owner of equity shares. Under the Rules QPE refers to a capital expenditure incurred under paragraph 2 of.

This expenses generally have high quantum of non invoice and URD Purchases and is very important for RCM. What come under administration expenses in financial statements. Company cars and fuel.

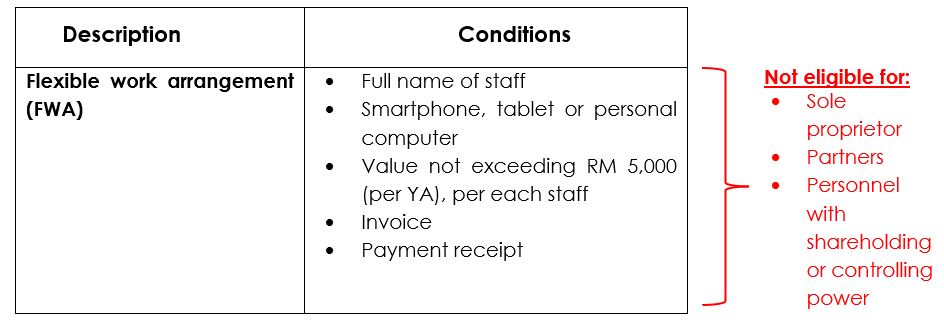

Computers loaned to an employee. Business goods given free to employees. Staff welfare expenses list Income Tax Goods and services Tax GST Service Tax Central Excise Custom Wealth Tax Foreign Exchange Management FEMA Delhi Value.

Staff Welfare needs to be categorized properly in different heads. It relates to food or beverage catered for employees. Expenses and income generated by employee welfare and morale activities should be reviewed for.

Any expenditure for the benefit of employees apart from their salary is commonly known as staff welfare expenses. Seeking permission to re-export the goods - Unflavored Supari Betelnu. This expenses generally have a high quantum of non.

Read more sales expense Rent repair maintenance bank charges legal expenses office supplies insurance. Bansal On January 14 2012. Income Subject to Tax Taxable Income.

Staff Welfare needs to be categorized properly in different heads. Head of staffwelfare. The eligibility is examined in light of the amendments made in provisions.

All administration related items included in it like administration staff salaries and. Welfare measures inside the work place. These expenses are.

Penalty us 43 of the Black Money Undisclosed Foreign Income Assets. Employee welfare measures are the efforts made by the employer to bring the desired results by motivating and satisfying their employees. Section 17 5 of the CGST Act puts restrictions on availment of ITC on many expenses especially where such expenses are incurred for the.

2 An employee who has substantial interest ie. Allowability of expenditure on employees welfare Expenditure on employees welfare activities including education of children of the employees is allowable as a deduction Published in 405. The following employees are deemed as specified employees.

An organization should always. Listing of Staff Welfare SW expenses are below to help in getting a sense of understanding the nature of this expense. Employee welfare raises the companys expenses but if it is done correctly it has huge benefits for both employer and employee.

A comprehensive list of welfare activities on labour welfare into two broad groups namely. As such providing employees with varied range of eligible expenses under this category. Transfer of pledge shares -.

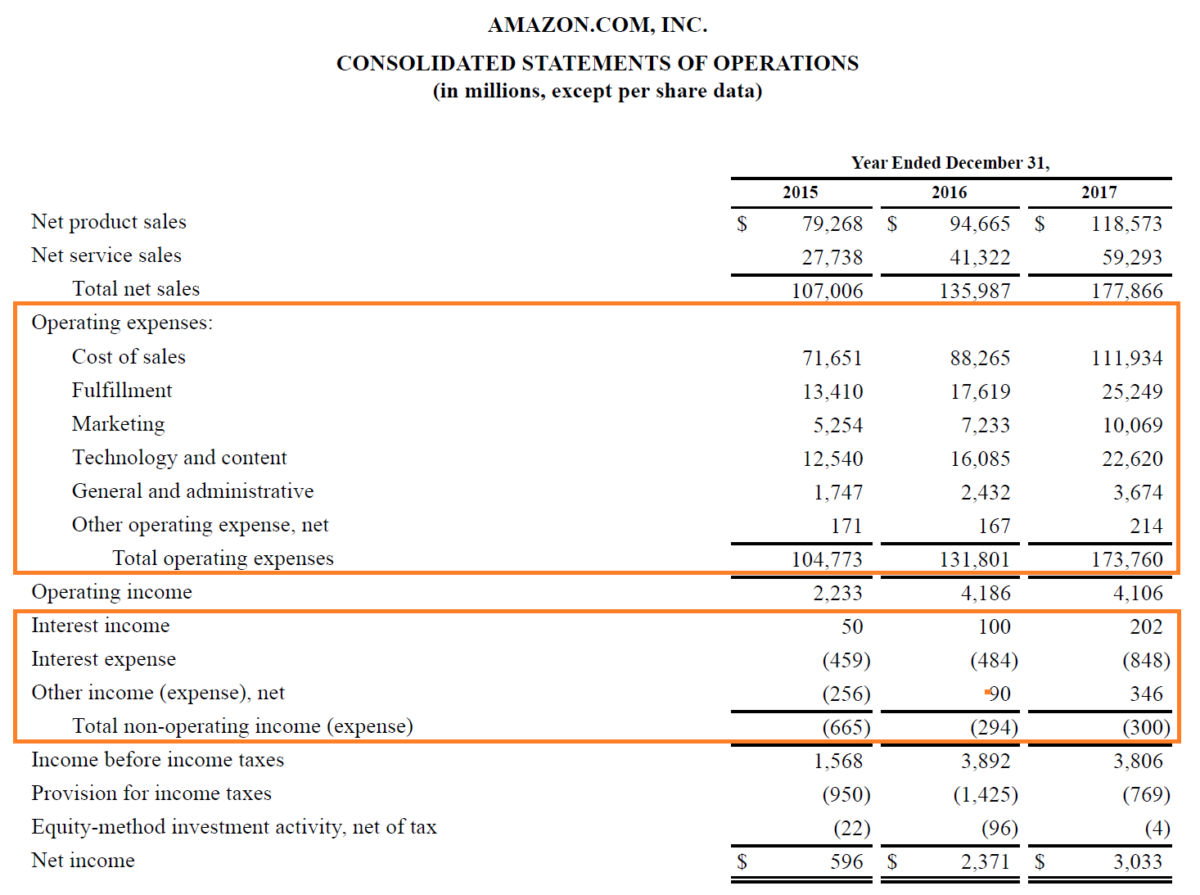

These are included as operating expenses in the Companys income sheet. According to SARS tax-deductible business expenses are expenses incurred in the operation of a business. Importance of employee welfare.

40 of the QPE incurred. Welfare measures outside the work place.

Staff Welfare Expenses Carunway

Federal Register Public Charge Ground Of Inadmissibility

What Is Direct And Indirect Expenses In Hindi प रत यक ष व यय और अप रत यक ष व यय क य ह Accounting Seekho

How To Create Employees In Tallyprime Payroll Tallyhelp

32 Important Pros Cons Of Welfare E C

List Of Tax Deduction For Businesses Cheng Co Group

What Benefits Do Employees Want The Most Resourcing Edge

Adjustments In Final Accounts Examples Explanation More

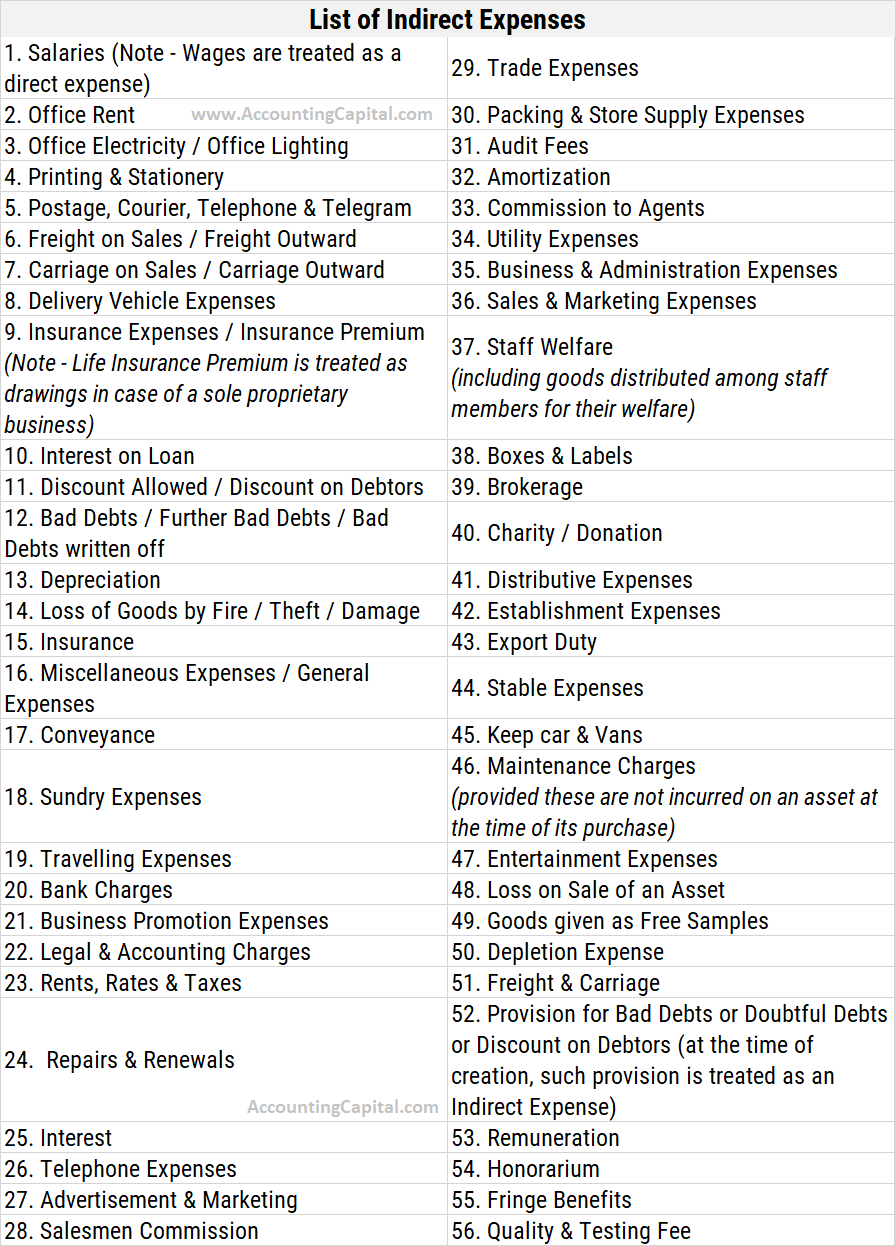

List Of Indirect Expenses With Pdf Accounting Capital

Dk Goel Solutions Chapter 1 Financial Statements Of Companies

Expense Report Template Track Expenses Easily In Excel Clicktime

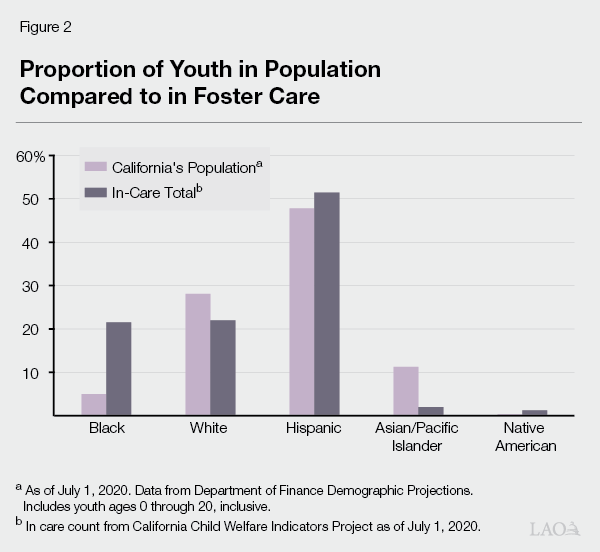

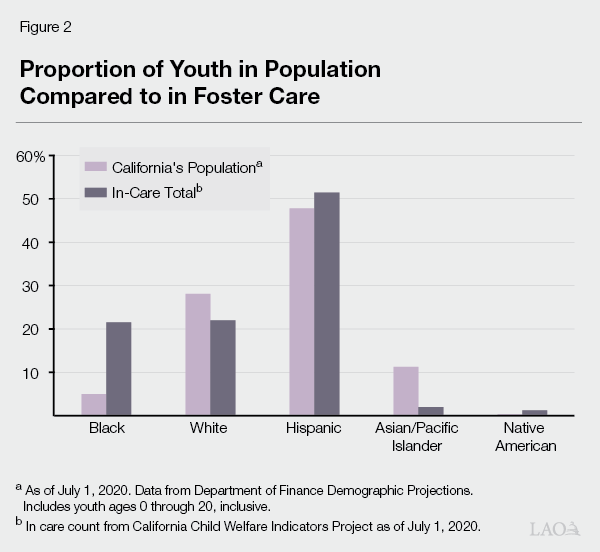

The 2022 23 Budget Analysis Of Child Welfare Proposals And Program Implementation Updates

List Of Tax Deduction For Businesses Cheng Co Group

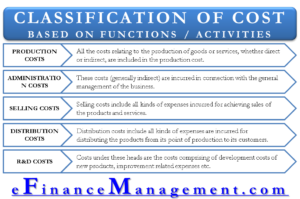

Classification Of Costs Based On Functions Activities Efm

List Of Tax Deduction For Businesses Cheng Co Group

Transaction Costs Theory An Overview Sciencedirect Topics

Expenses In Accounting Definition Types And Examples

Expense Report Template Track Expenses Easily In Excel Clicktime